In January 2022 the state government introduced a new statewide ‘Transport Zone’ to planning schemes which you can read about here.

Following this, on the 17th February 2022, the government introduced a new statewide planning provision. Clause 53.21 introduces exemptions for transport projects from planning permit requirements. The provision is specific to applications made by Transport Victoria and replaces councils as the decision maker with the Minister for Planning. The amendment was prepared by the Minister for Planning and also removes any third party appeal rights and public notification requirements for the applications.

The purpose of the amendment is clearly to fast track planning approval for essential state infrastructure projects earmarked by Transport Victoria to be built. Infrastructure development has been a mainstay of both the Labour and Liberal governments in recent years in Victoria and given 2022 is an election year, this amendment is expected to lead to the announcement of more major road and rail projects in the lead up to the election.

On the 20th January 2022 the minister for planning introduced a new Transport Zone state wide to planning schemes.

The new zone replaces the former Road Zone Categories 1 and 2 that were defined at clause 52.29 of the scheme. The new road zones are:

The new TRZ1 zone replaces the Public Use Zone (4) within the planning scheme to identify land used for state transport infrastructure and other major sections of infrastructure. Former Category 1 road zones become TRZ2 and Category 2 road zones become TRZ3. Clause 52.06 – 9 of the planning schemes has been updated to reference requirements for access ways and car parks to access roads in the transport zone 2 or 3. The most notable change is that the access to car parking spaces must be at least six metres from the road carriageway in either of these two zones.

The reason for the amendment was to make the planning schemes more concise and transparent in relation to roads and other infrastructure and to allow a more coordinated government response to infrastructure upgrades across the state. The minister claims that ‘consistent zoning for transport land will directly support the approval and delivery of a wider range of transport projects including Victoria’s Big Build.’

We concur that the replacement of the ‘Public Use Zone 4’ with a ‘Transport Zone 1’ is a more transparent measure to identify state significant infrastructure. The amendment also sees the Department of Transport replace VicRoads as the referral authority for planning permit applications.

Overall the amendment is largely a change to the name of the zones rather than any requirements within the zones. The requirements for car parks, access ways and crossovers largely remain the same and there is very little consequence of the change of zone on new or current applications.

The Victoria Budget for 2021-2022 was released in May 2021, introducing a number of new measures that will soon be voted on by the Victorian Parliament. A number of measures are directly targeted at the Victorian property sector including both tax increases and concessions.

The major changes include land tax increase by 0.25 per cent for taxable land holdings between $1.8 million and $3 million, and 0.30 per cent for taxable land holdings in excess of $3 million; a new rezoning tax where windfalls above $500,000 would be taxed at 50 per cent, with the tax phasing in from $100,000 and a premium stamp duty for property transactions above $2 million, attracting a $110,000 duty plus 6.5 per cent of the dutiable value in excess of $2 million.

Measures in relation to the property sector announced in the Budget are listed below, along with their expected start date:

Rezoning Tax

New windfall gains tax of up to 50% to be applied to planning decisions to rezone land. The total value uplift from a rezoning decision will be taxed at 50% for windfalls above $500,000, with the tax phasing in from $100,000.

Starting from 1 July 2022.

Stamp Duty

New premium land transfer duty (stamp duty) rate for property transactions with a value above $2 million, increasing stamp duty payable to $110,000 plus 6.5% of the dutiable value in excess of $2 million.

Applies to contracts entered into on or after 1 July 2021.

Land Tax

The land tax rates for high value landholdings will increase for taxable landholdings exceeding $1.8 million by 0.25 percentage points, and for taxable landholdings exceeding $3 million by 0.30 percentage points.

2022 land tax year

Victorian Treasurer Tim Pallas said during the budget announcement, $2.7 billion would be raised by a suite of measures and the “modest” increase would only affect a fraction of the 10 per cent of Victorians who pay land tax, which is not paid on owner-occupied homes. Mr Pallas said the rezoning tax is a move that would claw back around $40 million a year from developers and speculators who made huge profits after a local council’s “stroke of a pen” to rezone industrial land for residential use. According to the state government, the measure is aimed at balancing home buyers wanting to purchase a home and property investors who continue to profit from increasing property values.

Other than the headline tax hikes, the budget also announced other measures aimed at encouraging population into Melbourne CBD apartments:

Stamp Duty Concession within the City of Melbourne

Temporary land transfer duty (stamp duty) concessions for new residential property within the City of Melbourne local government area with a dutiable value up to $1 million. A 50% concession will be available for new residential properties. A full exemption will be available for new residential properties that have remained unsold for 12 months or more since completion of construction.

Concession applies to contracts entered into on or after 1 July 2021 and on or before 30 June 2022

Exemption applies to contracts entered into on or after 21 May 2021 and on or before 30 June 2022

Off-the-Plan Duty Concession

Temporary increase in the eligibility threshold for the off-the-plan duty concession to $1 million for all home buyers.

Applies to contracts entered into on or after 1 July 2021 and on or before 30 June 2023

Victorian Treasurer Tim Pallas said “It’s only fair that those making large profits return a reasonable proportion to the community – this means more Victorians can have the schools, hospitals and support they need and deserve. Our tax system is fair and progressive – making sure that everyone pays their fair share to support Victoria’s economic recovery.”

Sending a Message

The Budget will also revoke land tax concessions for private gender-exclusive clubs such as the Melbourne Club, which has all-male membership. The land tax concessions were intended for not-for-profit societies, rather than “increasingly anachronistic” elite clubs.

“We’re not saying that they’re illegal, we’re simply saying you shouldn’t get the gift of the taxpayer to conduct these bodies and certainly from our point of view the idea of male-only clubs, their time is well and truly passing,” Victorian Treasurer Tim Pallas said. The state government does not expect large savings made in that move, it was more about sending a message to the community.

Private Partnership to Boost Public Housing

The Victoria State Budget 2021-2022 also announced measures that are not tax related. A private-public partnership will create hundreds of social housing units as part of its $5.3 billion public housing build with 1,110 new homes to be built on government-owned land in Brighton, Flemington and Prahran.

The homes will be a mix of 619 social housing dwellings, 126 affordable homes and 365 market rental homes, including 52 specialist disability accommodation dwellings. Under the plan, the government will put in $50 million while a private consortium will provide $465 million upfront to construct the homes. The consortium will have a lease on the sites for 40 years, collecting income from the rent and maintaining the properties while the state government repays the $465 million to the consortium during that 40-year period.

Planning Minister, Richard Wynne, said after that time, all the property and homes would return to government hands to become social housing and “full consultation” with local communities on the design will take place and he hoped to have construction underway before the end of the year.

As part of a planning application process, we often see a condition within the planning permit that requires the permit applicant to enter into a Section 173 Agreement with the responsible authority, being the council in most cases. So what is a Section 173 Agreement and what are the obligations involved?

During the planning application process, the responsible authority (council) can negotiate an agreement with an owner of land to set out conditions or restrictions on the use or development of the land, or to achieve other planning objectives in relation to the land. These agreements are commonly known as section 173 agreements. The power to enter into the agreement arises under section 173 of the Planning and Environment Act 1987 (the Act).

The Act provides that a section 173 agreement can be entered into between a responsible authority and an owner of land (normally the registered proprietor). Provided the responsible authority and owner are parties to a section 173 agreement, other persons or bodies may be additional parties to the agreement and become bound by the terms of the agreement. This may include, for example:

- A planning authority or referral authority where it is useful for that body to coordinate its powers or functions in relation to the land.

Like other agreements, a section 173 agreement is a legal contract. However, a section 173 agreement can be recorded on the title to the land so that the owner’s obligations under the agreement bind future owners and occupiers of the land. A section 173 agreement can also be enforced in the same way as a permit condition or planning scheme.

Councils use a Section 173 Agreement as leverage to ensure the permit applicant and those who owns the land after will adhere to the conditions or restrictions by including the preparation of Section 173 Agreement as a condition in the planning permit. The purpose of an agreement is to achieve planning objectives for an area or particular parcel of land than is not possible when relying on other statutory mechanisms.

What can an agreement cover?

Unlike a planning scheme provision or permit condition, which allows something to be done, a section 173 agreement can expressly require something to be done. This is particularly useful where a responsible authority wants to guarantee certain outcomes prior to, or as part of, the granting of a planning permit for a specific use or development. The Act allows the section 173 agreement to provide for:

- The prohibition, restriction or regulation of the use or development of land.

- Conditions subject to which the land may be used or developed for specified purposes.

- Any matter intended to achieve or advance the objectives for planning in Victoria under the planning scheme or an amendment.

This provides a wide scope for agreements. However, there should generally be a connection between the agreement and the specific planning outcomes sought to be achieved in relation to the land over which the agreement will be recorded. Section 173 agreements have been used in a wide variety of matters. Some examples are:

- Coordination of development with adjoining landowners or other regulatory authorities.

- To provide for staged developments.

- Rehabilitation of property, repair of the environment, heritage protection or vegetation protection.

- Provision of community infrastructure or specific development infrastructure – such as open space or facilities on the land or nearby land.

- Securing developer contributions.

- Restrictions on change of use, or abandoning existing use rights.

- Limits on future development, including neighbourhood agreements to protect neighbourhood character

- Planning ‘trade-offs’, such as a planning concession on one property based on a commitment to do something on another property.

Example of a Section 173 Agreement:

CS Town Planning has been engaged by Simond’s Homes as part of their collaboration with Department of Health and Human Services to build social housing around Victoria. Our team of experts are involved in obtaining planning permits for the program from different councils within Victoria, such as Greater Geelong Council, Bendigo Council, Monash City Council and many other councils. In many of the permits successfully obtained, a condition involved the land owner of the property (DHHS) to enter into a Section 173 Agreement with the Responsible Authority (Council). Using a project in Norlane, we provide an example on how Section 173 Agreement is utilised by Greater Geelong Council to ensure their objective is achieved.

Greater Geelong Council has a long history of land owners connecting the stormwater pipes to points other than the legal point of discharge, causing floods and complaints by residents. This may be caused by sloped topography of a lot of the land or short cuts taken during the development of the dwellings. Greater Geelong Council wants to ensure all new dwellings are connected to the legal point of discharge correctly and well maintained moving forward. Hence the condition within the permit requiring the land owner (DHHS) to enter into a Section 173 Agreement. The condition of the permit reads:

Unless otherwise approved by the Responsible Authority and prior to the Commencement of the Development, the landowner must enter an agreement with the Responsible Authority pursuant to Section 173 of the Planning and Environment Act 1987. All costs associated with setting up the agreement must be borne by the landowner. The agreement is to be registered on title and run with the land, and is to provide to the satisfaction of the Responsible Authority:

- All storm water runoff is to be collected on site and discharged to the legal point of discharge using a pump system or as otherwise nominated by the responsible authority. The pump system is to be designed and constructed in accordance with Australian Standard 3500 Part 3.2 Section 9

In order to meet this condition of the permit, a Section 173 agreement is required to be prepared by the land owner’s solicitor. Once the draft Section 173 agreement is prepared, the solicitor who represents the council will than review and advice any amendment required.

Depending on the purpose of the Section 173 agreement, the terms in the agreement are tailored to meet the purpose and the condition of the permit. In the Norlane example, the Section 173 agreement has clauses that list out the ‘Specific Obligations of the Owner’:

- Stormwater runoff is to be collected on site and discharged to a legal point of discharge using a Pump System, or as otherwise directed by the Responsible Authority.

- In the event of any operational difficulties with the Pump System installed on the Land pursuant to the Permit, the Owner must promptly and at its cost rectify those difficulties to the satisfaction of the Responsible Authority.

Other than the specific obligation, the Section 173 agreement also specify that the Land Owner:

- Will not sell, transfer, dispose of, assign, mortgage or otherwise part with possession of the Land or any part of it without first providing to its successors a copy of this Agreement.

The purpose of this clause is to ensure the section 173 agreement also applies to future owners and occupiers of the land.

After the draft Section 173 agreement is approved by council, both the council and the land owner will execute the Section 173 agreement. Once the Section 173 agreement is executed by both parties, the Section 173 agreement is then lodged to Titles Office and officially registered on the title. The condition in the planning permit is now met.

The Section 173 Agreement in the Norlane example is just one of many Section 173 agreement examples. Meeting a Section 173 Agreement planning permit condition can be difficult, if you have any questions about the process, feel free to contact the team at CS Town Planning who will be able to assist.

Recently, City of Stonnington started to exhibit planning scheme amendment – C296ston which seeks to introduce a Development Contribution Plan (DCP) to the Stonnington Planning Scheme. The amendment will require all land owners who are seeking to utilise their property’s development potential to provide a monetary contribution to infrastructure upgrades and community facilities like roads, footpaths, drainage and community facilities such as an Aquatic Centre upgrade.

A Development Contribution Plan (DCP) is often used in regional urban growth areas where basic infrastructure are lacking, such as City of Wyndham or City of Casey, as a mechanism to levy contributions from new developments to go towards the provision of planned infrastructure required to accommodate the needs of a growing population.

In accordance with the Planning and Environment Act 1987, the State Government’s Development Contributions Guidelines 2007 and associated Ministerial Directions, the types of projects that are able to be funded through a DCP must be ‘capital works’, which can be defined as:

- A new item of infrastructure (i.e. a new childcare facility);

- An upgrade to the standard of provision of an existing infrastructure asset or facility (i.e. improvements to a kindergarten to provide for 3 year old sessions);

- An extension to an existing asset or facility (i.e. adding female change rooms to a pavilion); or

- And the replacement of an infrastructure item after it has reached the end of its economic life (i.e. reconstruction of a road).

And the types of infrastructure projects that may be included within a DCP must be either:

- Basic to health, safety or wellbeing of the community,

- Or consistent with the community expectations of what is required to meet its, safety or well being,

- Roads, paths, drainage, open space improvements and community facilities.

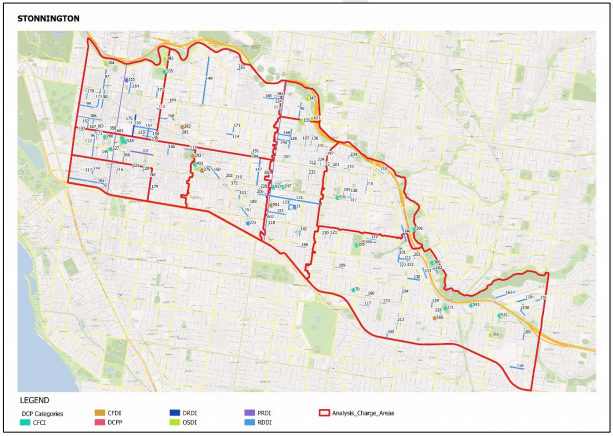

City of Stonnington are proposing this amendment because the city is experiencing significant residential, retail and commercial growth and the council believes the growth will have an impact on the city’s infrastructure, placing financial burden on the Stonnington community. The proposed Development Contribution Plan aims to ensure that developers make a fair contribution to the community and offset part of the cost of the planned infrastructure work. The research data provided by the City of Stonnington identifies an extensive list of infrastructure projects based on the city’s 10 Year Capital Works Program 2020/2021 that would be eligible to be funded under a Development Contribution Plan program. The proposed Development Contribution Plan does not replace the Open Space Levy, both contributions will be charged concurrently, further increasing the development costs.

According to City of Stonnington, the council have identified 197 projects within the municipality which qualify for a DCP and the amendment will allow the council to collect approximately $49.5 million of the estimated total cost of these projects (total cost is approximately $259 million). The full list of projects can be viewed in the council’s Municipal Wide Development Contribution Plan 2020 incorporated document.

What developments would make a contribution under the DCP?

If the amendment is approved and gazetted, all new development proposing to increase the number of dwellings and/or increase leasable commercial, retail or industrial floor space will be required to make a proportionate contribution.

Meaning even minor developments such as a two lot residential subdivision, extension to a shop or a new mezzanine level within a warehouse will be required to pay the Development Contribution levy under the new amendment.

How much would a new development be levied?

The amount levied to a new development is calculated based on the developments’ projected ‘share of usage’ of the planned infrastructure. The cost of an infrastructure project is apportioned to all demand units (existing development, external demands and new development). The estimated share of cost attributed to new development is approximately 19 percent of the cost of infrastructure.

The City has been divided into nine analysis areas/charging areas, based on suburb boundaries:

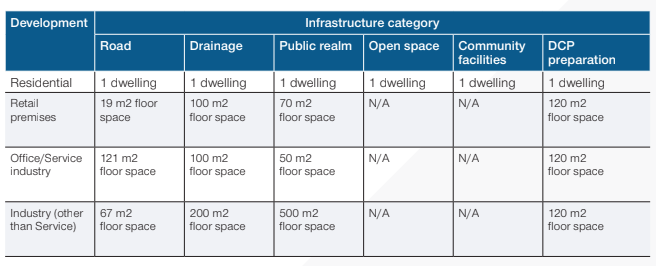

A demand unit is than calculated based on the development type and used as a measure in the calculation of a development contribution. To calculate a common demand unit across development types (residential, commercial, retail, industry) an equivalence ratio is used to convert the amount of existing and projected development for each type, into a proportional number of common demand units. Similar to adding together different currencies, where a formula is used to convert them into the same currency.

In the case of a demand unit, existing and proposed dwelling numbers and commercial/ industrial/retail floor space are converted into the same measure. These ratios differ depending on the nature of the infrastructure category (drainage, public realm, road, open space, community facilities) as illustrated in the table following:

Using residential developments as an example, the charges payable per new dwelling are as following:

Using a two lot subdivision development in Malvern as an example, the Development Contribution levy payable is estimated to be as follow:

- $1,210.00 of Community Infrastructure Levy

- $1,995.15 of Development Infrastructure levy (Residential)

- Total Levies payable – $3,205.15 per new dwelling.

If a retail shop owner in South Yarra is proposing to do a 500 sqm extension to the existing retail shop, the estimated Development Contribution Levy payable is calculated as follow:

- $0 Development Infrastructure Levy (Residential)

- $13,560.00 Development Infrastructure levy (retail or commercial or industrial)

- Total Levies payable – $13,560.00

If a developer is seeking to do a 20 dwelling residential development with 600 sqm of retail space in Armadale, the Development Contribution levy payable is estimated to be as follow:

- $24,000.00 of Community Infrastructure Levy

- $39,179.60 of Development Infrastructure Levy (Residential)

- $24,054.00 of Development Infrastructure Levy (retail or commercial or industrial

- Total Levies payable – $87,433.60

Please note the calculations provided by City of Stonnington at this time are estimations only. The calculated contribution amounts are current as of 1 August 2020. They will be adjusted annually on 1 August each year to cover the cost of inflation and fluctuations in the cost of construction. The council has developed an estimation calculator and published on the Council’s engagement platform.

Are there transitional provisions for payment of levies and when does the DCP need to need to be paid?

There are no transitional provisions for the Amendment C296ston. If Amendment C296ston is approved, levies will need to be paid from the time the amendment is gazetted.

When you lodge your planning or building application, Council will provide you with an indication of the amount that you will need to pay. Confirmation of the exact amount will be provided when the planning or subdivision permit is issued or when a building surveyor is appointed.

Payment of the Development Infrastructure levy must be made at one of the following stages:

Payment of the Community Infrastructure Levy must be made before a date of issue of a Building Permit.

- Before a Statement of Compliance for a subdivision is issued

- Prior to commencement of works

- Before a building permit is issued

What happens if I have been issued a planning permit?

If a planning permit has been issued before the approval of the DCP, the levy will not be required to be paid. However, this does not mean the Development Contribution Levy is not required to be paid. Under the proposed amendment, the contribution will be payable if you require a building permit and it is issued after the approval of the DCP. If you amend your planning or building permit after the Development Contribution Plan is approved and gazetted, you may still be required to pay a levy or levies.

The majority of land owners will not start the build immediately after the planning permit is approved and often wait for one or two years before applying for a building permit. If the amendment is approved after your planning permit was issued but before your building permit is issued, the Development Contribution Levy will still be required to be paid.

Another trigger for the Development Contribution Levy is when a land owner applies for a subdivision permit and it is issued after the DCP has been incorporated into the Stonnington Planning Scheme.

The proposed amendment is currently on exhibition from 25 February to 31 March 2021 and is available for inspection at Stonnington City Council or online at the Department of Environment, Land, Water and Planning website at this link.

The City of Stonnington Council is also hosting two online information sessions:

Session 1 – Tuesday 16 March, 6pm to 7pm, click here to register on councils website.

Session 2 – Thursday 18 March, 12pm to 1pm, click here to register on councils website.

Any person who may be affected by the Amendment may make a submission to the planning authority. Submissions about the Amendment must be received by City of Stonnington by 31 March 2021.

A Panel Hearing for the proposed amendment is schedule to commence on the 2 of August 2021. Depending on the result of the Panel Hearing, the proposed Amendment may either require the council to make adjustments to the amendment, similar to the outcome of Monash Council proposed Amendment C148, or proceed to seek approval from the Minister of Planning. If you would like to read about Monash’ proposed Amendment C148, click here.

If you are directly impacted by the proposed development contributions proposed by Council and would like to know how much you may have to pay council please give us a call to discuss your case.

Planning Minister, Richard Wynne, announced some upcoming new standards for apartment design in Victoria on Sunday February 28th. The new standards will become part of Clause 55.07 – Apartment Developments and the particular provision at Clause 58 – Apartment Development.

Similar to the state’s first set of apartment standards introduced back in 2016 , these guidelines don’t mandate minimum lot sizes in the way that New South Wales’ SEPP 65 code does. The new standards focus on new landscaping standards to boost green space in and around apartment buildings, requirements for more deep soil planting to encourage canopy tree growth and the need for durable facades that will retain their aesthetics for longer.

Although the new standards are not facing as much opposition from developers as the first set of rules did back in 2016, it is expected the 2021 guidelines will again raise the costs for developers and buyers. Developers will be required to allow for more areas for landscaping as well as using more expensive and durable materials in residential developments. Property Council of Australia’s Victoria executive director, Danni Hunter, welcomes the new standards and said “We’re using our homes and our apartments as rest and exercise space and as a workplace, design has to be really flexible and adapt to what purchasers are telling us they want”.

Under the new rules, any apartment building with more than 10 residences must provide communal spaces, such as a barbecue area or seating, giving residents access to fresh air and apartment buildings taller than five storeys will be required to avoid “wind tunnelling” through sensitive design, and balconies will be eliminated on buildings taller than 40 metres to reduce overshadowing and “windswept” and underused balconies.

Not all developers were so welcoming of these new standards. “The industry remains concerned that the rigid application of these guidelines will lead to increasing construction costs that will erode project viability and ultimately lead to reduced housing supply and housing affordability,” the Urban Development Institute of Australia’s Victorian president and developer Ashley Williams said.

The full list of new standards is yet to be release. The draft version of the rules can be found here.

Following the illegal demolition of a heritage listed building in 2016 (Read article here), the Victorian Government is planning to introduce a piece of legislation which could stop development on a property for up to a decade if heritage buildings are illegally demolished.

The proposed legislation will cover buildings that have been unlawfully demolished, either in full or in part, and where the owners have been charged with unlawful demolition. Victorian Planning Minister, Richard Wynne, said the legislation is targeted at developers who plan to illegally demolish buildings and expecting to reap windfall gains from just selling or rebuilding on their land.

The legislation was prompted by the unlawful demolition of the 160-year-old Corkman Irish Pub in Carlton in 2016. The Corkman Pub, formerly known as the Carlton Inn Hotel, was built in 1858. Although it was not on the Victorian Heritage Register, it was covered by a heritage overlay. It was demolished over a weekend in 2016, a week after a fire was lit inside the building. The developer was later jailed for a month and ordered to pay more than $400,000 in fines and legal costs.

Victorian Planning Minister, Richard Wynne, said the illegal demolition of the Carlton Inn Hotel was “unprecedented in planning in the state of Victoria” and strong action to protect heritage buildings was needed.

The proposed legislation will also enable existing permits to be revoked and allow for new permits to be issued for specific purposes, such as building a park or reconstruction or repair of the heritage building. These new provisions are a significant strengthening of the current enforcement regime and are expected to act as a powerful deterrent to the unlawful demolition of buildings of heritage significance.

The minister also said the reform complemented measures that the Government introduced in 2017, which made it an indictable offence for a builder or person managing building work to knowingly carry out works without a permit or in the contravention of the Building Act, the regulations or their permit.

Melbourne is home to many heritage buildings and present major hurdles for planning applications. On a separate planning matter relating to planning applications affected by heritage overlays, St Vincent’s Hospital recently lodged plans to demolish the building the corner of Victoria Parade and Nicholson Street, a building that overlooks Carlton Gardens. While the building will not be illegally demolished, the hospital plans to replace it with a new 11-storey tower with glass façade with parts of the original façade at Daly Wing and Brenan Hall retained. The proposal already raising concerns that it would impact the World Heritage value of the Royal Exhibition Building moments after lodging the plans to City of Yarra Council. For the full article, click here.

It is commonplace for land owners to consider ‘heritage overlays’ and ‘heritage listings’ as significant barriers to the development potential of sites. While there is credence to this belief, it is not true to say that just because a property has some form of heritage control that the site is undevelopable and demolition is not possible. In an article produced by our team, we look at the town planning heritage controls that can affect a site and describe the likely implications of each for the development potential of the site. If you would like to know more about how to deal with ‘heritage overlays’ and ‘heritage listings’ in a planning permit application.

On 1 Feb 2021, the Victorian government announced a prohibition on the use of high risk cladding products on new multi-storey buildings, effective on the same day.

Minister for Planning, Richard Wynne, announced the prohibition on flammable aluminium composite panels (ACP) and rendered expanded polystyrene (EPS) as external wall cladding on all future multi-storey developments within Victoria.

The ban will prohibit the use of these high-risk products on apartment buildings, and other residential buildings such as hotels and aged care facilities with two or more storeys. The ban also extends to office buildings, shopping centres or other retail premises, warehouses, factories and car parks with three or more storeys.

The aim of the ban is limit the potential risk to the public from any future inappropriate use and reduces the risk of cladding fire incidents follow the incidents at Grenfell Tower, London in June 2017 and Neo200 building in Melbourne CBD in February 2019.

Both of these buildings were covered in aluminium composite panels (ACP). Investigations were conducted to examine why fire spreads so quickly when these claddings ignites, the article can be found here.

According to the media release, published by the Premier of Victoria, the Government also commissioned a cost benefit analysis, which found the ban will result in a net economic benefit of approximately $1 million annually due to reduced professional indemnity insurance costs. Building surveyors are responsible for signing off on buildings and it is required that a register building surveyor must have professional indemnity insurance, without any exemptions. However, after the cladding crisis, majority of the insurance underwriters no longer provide such cover, meaning building surveyors needed to pay premium in order to stay registered.

As part of the announcement, the Victorian Building Authority will be given extra power to enforce the cladding ban in its role as Victoria’s building regulator. Building companies that breach the ban will be fined up to $400,000 and Individuals can be fined up to $80,000.

Back in July 2019, the Victorian Government already established a $600 million Cladding Rectification Program to enable rectification of hundreds of buildings identified through the State-wide Cladding Audit conducted by the Victorian Building Authority and as part of the program, the Victorian Cladding Taskforce recommended prohibiting the use of combustible cladding in multi-storey buildings. Since the recommendation was made, the government conducted a five-month consultation process with the industry last year on the proposed ban. It is expected by the government that the building industry will not oppose to the new rules.

The new rule introduced will not dramatically affect the town planning aspects of developments within Victoria. Most likely effect on current town planning applications will be local councils issuing request for further information, requesting for changes in the material schedule. For the permit approved development, the responsibility of enforcing the ban will lie with the building surveyors.

More information about the specific cladding products and technical information about the risk posed by their inappropriate use can be found here.

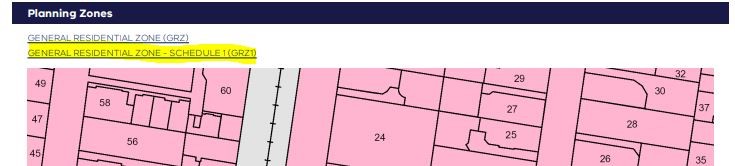

On 23rd Dec 2020, Amendment GC172 was approved by the Minister for Planning and was published on the Government Gazettal, marking the end of building height inconsistencies in residential zones across Victoria which was caused by the Amendment VC110 in 2017.

Back in 2017, Amendment VC110 was introduced to strengthen building height controls in the Neighbourhood Residential Zone (NRZ) and General Residential Zone (GRZ), by introducing a mandatory default maximum building height requirement of:

- 11 metres and 3 storeys in the GRZ; and

- 9 metres and 2 storeys in the NRZ.

At the time of approval of VC110 amendment, local councils of Ararat, Boroondara, Greater Geelong, Glen Eira, Knox, Melbourne, Queenscliffe, Wellington and Whitehorse had lower maximum building height in a local schedule to a zone compared to the VC110 amendment. This resulted in these councils of Victoria having a maximum building height specified in a schedule to a residential zone that is lower than the maximum building height specified in the reformed residential zone.

For example, a building height lower than 9 metres specified in a Neighbourhood Residential Zone schedule and a height lower than 11 metres specified in a General Residential Zone schedule at the date the reformed residential zones came into operation under Amendment VC110 on 27 March 2017.

To rectify the discrepancies, Amendment GC172 was prepared by the State Planning Service of the Department of Environment, Land, Water and Planning (DELWP) with the following changes:

Ararat Planning Scheme

- Amends Neighbourhood Residential Zone – Schedule 1 (NRZ1) to modify the maximum building height from 8 metres, to 9 metres and 2 storeys.

Boroondara Planning Scheme

- Rezones land of specific areas from the General Residential Zone – Schedule 1 (GRZ1) (except land affected by Design and Development Overlay – Schedule 1 (DDO1)) to Neighbourhood Residential Zone – Schedule 1 (NRZ1) to retain the maximum building height of 9 metres.

- Amends General Residential Zone – Schedule 1 (GRZ1) (land affected by Design and Development Overlay – Schedule 1 (DDO1)) to modify the maximum building height from 9 metres, to 11 metres and 3 storeys

- Amends General Residential Zone – Schedule 2 (GRZ2) to modify the maximum building height from 10.5 metres, to 11 metres and 3 storeys.

- Amends General Residential Zone – Schedule 3 (GRZ3) to modify the maximum building height from 10.5 metres, to 11 metres and 3 storeys.

- Amends Clause 21.01-3, Clause 22.02-3 and Clause 22.05-5 to make consequential changes to the strategic framework plan and the content of the clause to be consistent with the reformed residential zones.

- Amends clauses 21.05-1 and 21.05-4 to make consequential changes to Table 1 and the housing framework plan to be consistent with the reformed residential zones.

Glen Eira Planning Scheme

- Amends General Residential Zone – Schedule 1 (GRZ1) to modify the maximum building height from 10.5 metres, to 11 metres and 3 storeys.

- Amends General Residential Zone – Schedule 2 (GRZ2) to modify the maximum building height from 10.5 metres, to 11 metres and 3 storeys.

- Amends General Residential Zone – Schedule 3 (GRZ3) to modify the maximum building height from 10.5 metres, to 11 metres and 3 storeys.

Greater Geelong Planning Scheme

- Rezones land of specific areas from the Residential Growth Zone – Schedule 2 (RGZ2) to General Residential Zone – Schedule 4 (GRZ4) and modifies the maximum building height from 10.5 metres, to 11 metres and 3 storeys

- Rezones land of specific areas from the General Residential Zone – Schedule 2 (GRZ2) to Neighbourhood Residential Zone – Schedule 8 (NRZ8) to retain the maximum building height of 9 metres.

- Amends Clause 21.06-3 to make consequential changes to the content of the clause to be consistent with the reformed residential zones.

Knox Planning Scheme

- Rezones land of specific areas from the General Residential Zone – Schedule 2 (GRZ2) to Neighbourhood Residential Zone – Schedule 4 (NRZ4) to retain the maximum building height of 9 metres.

- Rezones land of specific areas from the General Residential Zone – Schedule 5 (GRZ5) to Neighbourhood Residential Zone – Schedule 5 (NRZ5) to retain the maximum building height of 9 metres.

- Rezones land of specific areas from the General Residential Zone – Schedule 6 (GRZ6) to Neighbourhood Residential Zone – Schedule 6 (NRZ6) to retain the maximum building height of 9 metres.

- Amends General Residential Zone – Schedule 3 (GRZ3) to modify the maximum building height from 9 metres, to 11 metres and 3 storeys.

- Amends Neighbourhood Residential Zone – Schedule 1 (NRZ1) to modify the maximum building height from 8 metres, to 9 metres and 2 storeys

- Amends Clause 21.06-6 to make consequential changes to the content of the clause to be consistent with the reformed residential zones.

Melbourne Planning Scheme

- Rezones land of specific areas from the General Residential Zone – Schedule 2 (GRZ2) to Neighbourhood Residential Zone – Schedule 3 (NRZ3) and modifies the maximum building height from 8 metres, to 9 metres and 2 storeys.

- Rezones land of specific areas from the General Residential Zone – Schedule 4 (GRZ4) to Neighbourhood Residential Zone – Schedule 4 (NRZ4) and modifies the maximum building height from 9 metres and 10 metres, to 10 metres and 2 storeys

- Amends Neighbourhood Residential Zone – Schedule 2 (NRZ2) to modify the maximum building height from 8 metres, to 9 metres and 2 storeys.

Queenscliffe Planning Scheme

- Amends General Residential Zone – Schedule 1 (GRZ1) to modify the maximum building height from 8.5 metres, to 11 metres and 3 storeys.

- Amends Neighbourhood Residential Zone – Schedule 1 (NRZ1) to modify the maximum building height from 8.5 metres, to 9 metres and 2 storeys.

- Amends Neighbourhood Residential Zone – Schedule 2 (NRZ2) to modify the maximum building height from 6 metres, to 9 metres and 2 storeys.

Wellington Planning Scheme

- Amends Neighbourhood Residential Zone – Schedule 1 (NRZ1) to modify the maximum building height from 4.5 metres, to 9 metres and 2 storeys.

Whitehorse Planning Scheme

- Amends General Residential Zone – Schedule 2 (GRZ2) to modify the maximum building height from 10.5 metres, to 11 metres and 3 storeys.

- Rezones land in the General Residential Zone – Schedule 6 (GRZ6) to Neighbourhood Residential Zone – Schedule 8 (NRZ8) to retain the maximum building height of 9 metres.

- Amends Clause 21.06-9 to make consequential changes to the housing framework plan to be consistent with the reformed residential zones.

The full gazetted Explanatory Report can be downloaded here.

The planning scheme controls maximum building heights throughout Victoria. The amendment GC172 ensures that there is consistency and certainty about maximum building heights through the reformed residential zones. The department hopes this will improve the usability of the affected planning schemes and provides greater certainty for landowners and the community with respect to consistent use and application of residential zoning tools across Victoria.

How does this amendment affect land owners?

Although Amendment GC172 seems to be simply rectifying the oversight caused by Amendment VC110 back in 2017, the Devil is in the details and GC172 may have a material impact on land owners in terms of development outcomes that can be achieved.

In areas such as Boroondara, Whitehorse, Melbourne, Knox and Greater Geelong, where some land are immediately rezoned from the General Residential Zone to Neighbourhood Residential Zone, whilst there are no reduction to the maximum height that can be achieved, it is important to note that the Neighbourhood Residential Zone has a maximum height limit of two-storeys whereas the General Residential Zone allows for height up to three-storeys.

Furthermore, the objectives of the Neighbourhood Residential Zone and General Residential Zone are clearly different in terms of the intensity of residential development that is expected.

Using Knox Planning Scheme as an example.

The objectives of General Residential Zone reads:

- To encourage development that respects the neighbourhood character of the area.

- To encourage a diversity of housing types and housing growth particularly in locations offering good access to services and transport.

Whereas the Objectives of Neighbourhood Residential Zone reads:

- To recognise areas of predominantly single and double storey residential development.

- To manage and ensure that development respects the identified neighbourhood character, heritage, environmental or landscape characteristics.

Given difference of the objectives, council planners may assess development proposals differently.

How does this affect current applications?

Amendment GC172 does not have transition provisions meaning the rezoning of residential land takes immediate effect. If there is an application for a three-storey development within the General Residential Zone, and the land has been rezoned to the Neighbourhood Residential Zone, then the application will now be assessed against the new zoning and it is likely the development would now be refused given it exceeds the mandatory height requirement of two storeys. On the flip side, if a permit was approved under Neighbourhood Residential Zone, the permit applicant can lodge a permit amendment to take advantage of the new zoning.

All the documents that are published on the Government Gazettal can be found here. If you require further information or have any queries in relation to the Amendment GC172 or any town planning matters, please feel get in touch with our team.

Subdivision has always been a popular method of releasing the financial equity in a property. It allows property owners to add another dwelling or even rebuild a number of townhouses on one block of land. In this article, we will explain what is the process involved to obtain Plan of Subdivision for the newly created dwellings, the final step of your subdivision project.

Before we get to the final stage of the process, it is important to ensure it is feasible to subdivide your property and choosing the right property for subdivision is not an easy task. Some simple tools can help you to conduct initial due diligence for a property, such as checking the zoning and planning overlay controls.

Our team has informative articles on how to confirm if a property can be subdivided and you can read about them here.

Subdivision has always been a popular method of releasing the financial equity in a property. It allows property owners to add another dwelling or even rebuild a number of townhouses on one block of land. In this article, we will explain what is the process involved to obtain Plan of Subdivision for the newly created dwellings, the final step of your subdivision project.

Before we get to the final stage of the process, it is important to ensure it is feasible to subdivide your property and choosing the right property for subdivision is not an easy task. Some simple tools can help you to conduct initial due diligence for a property, such as checking the zoning and planning overlay controls.

Our team has informative articles on how to confirm if a property can be subdivided and you can read about them here.

In our previous articles, we also explained subdivision involves designing a development layout for your property that meets your local council’s town planning policy framework, and also complies with the regulations governing Victorian subdivision, commonly known as ResCode.

The local regulations vary from Council to council meaning that a subdivision proposal in the Monash or Boroondara Council area may not receive support in neighbouring Whitehorse Council or nearby Banyule Council or Glen Eira Council. It is important to engage a professional with local experience before commencing to avoid common pitfalls.

To read more about the processes of getting a planning approval from your local council, click here.

Now that you have a building design that you like and been checked by an expert town planner to ensure it all complies with the regulations of your local council, you are ready to lodge an application to your local council for planning permit for development and subdivision consent.

Once we have obtained a planning permit for development, subdivision consent and a building permit from your local council, the builder of your choice can start construction of the townhouses in line with the approved development application and subdivision consent. At this stage, a registered land surveyor can also be engaged to complete the Property Subdivision Survey of the new dwellings to get a subdivision certificate in Victoria.

The process of obtaining Plan of Subdivision for the newly created dwellings:

The registered land surveyor of your choice will undertake fieldworks for a surround boundary survey of the subject land as well as obtaining a survey datum in the street. This will confirm the accurate location of current boundaries, existing easements and any improvements or infrastructure.

- A Plan of Subdivision is drafted.

- A draft subdivision plan clearly showing the current title arrangements with the proposed additional lots to be created. Property boundary dimensions and angles are delineated in plan and elevation view for each separate proposed titles.

- The draft plan will then be sent to the client for approval.

4. A subdivision application is then submitted to the local council by the land surveyor using SPEAR (Surveying and Planning through Electronic Applications and Referrals) for;

- A Planning Permit for Subdivision.

- A Certification of the Plan of Subdivision.

The SPEAR system will refer the plans to all of the relevant service authorities such as Water, Sewer, Gas, Electricity and Drainage for assessments. At this stage, council may request further information but the below outlines the next steps to finishing the subdivision.

- Council will generally take 3 months to process the application and will then issue a Planning Permit for subdivision. This Planning Permit will contain conditions that will need to be met in order to complete the subdivision. The most common condition will be that each newly created lot must be independently serviced. As the owner who benefits from the value of a newly created block of land, it is important that you be aware that you must pay to connect the newly created blocks to sewer, electricity and water infrastructure. This connection process and the cost cannot be passed to a purchaser of a new block and the connection process must be completed before the new title for the block can be released.

- The surveyor then completes the final documentation for registration of the plan at Land Use Victoria (Titles Office)

- The plan will then be released to the client’s solicitor for the final step, being the registration of the plan & the process is now completed

Now that the dwellings are built and Plan of Subdivision are obtained for each of the newly created lots, the properties can now be sold to a new owner or held by the current owner for investment purposes.

There are various elements to be considered when subdividing land or buildings. These include:

- Real estate prices in your local area to determine whether the project will be profitable;

- Knowing the associated application costs of the Council and the infrastructure connection when completing a subdivision;

- An effective development layout so that the maximum value of the land is achieved;

- Being aware of any existing site features, such as trees and easements, which may restrict the subdivision potential of the land

Our team has the vision, creativity and demonstrated industry experience to exceed your expectations and deliver a fantastic return on your investment.

Take the stress out of your subdivision project by letting our experts complete the project efficiently and successfully.